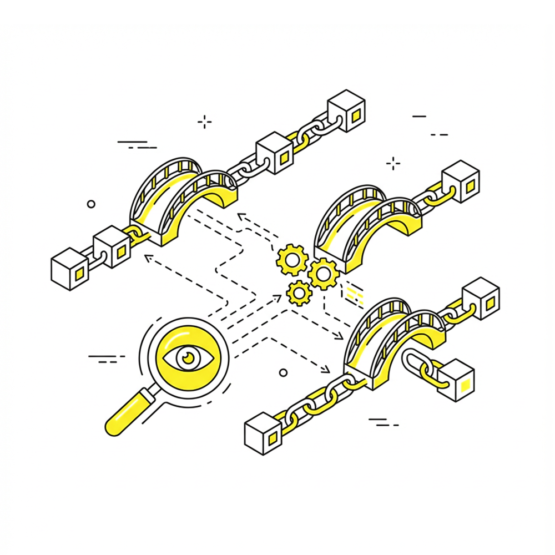

Cross-Chain Integration & Bridges

Applications and assets often need to interact across multiple blockchains. Cross-chain systems rely on secure messaging, state verification, and predictable failure handling.

Enabling Seamless Interactions Across Blockchain Networks

We collaborate with interoperability frameworks, bridging protocols, and custom routing logic to support multi-chain operations, such as chain integration moving stablecoin liquidity between Ethereum and Polygon and others.

Benefits and Use Cases

Coordination of assets and workflows across ecosystems

Reduced reliance on a single chain or network environment

Extended reach for applications and liquidity models.

Controlled risk exposure using structured validation layers.

Multi-chain load optimization and efficiency

Modular interoperability across decentralized systems

Operational redundancy and continuity assurance

Access to diverse security models

Technology Solutions

Cross-chain messaging frameworks

Integration with established messaging protocols to ensure state synchronization and facilitate event forwarding.

Bridging and Asset Transfer Logic

Token and asset transfer processes with validation and escrow systems. Example: Cross-chain integration moving stablecoin liquidity between Ethereum and Polygon.

Multi-Chain Application Flows

Coordinating actions across chains with well-defined fallback behavior.

Security and validation controls

Guard against replay, routing errors, and malicious relay activities.

Performance Optimization

By focusing on reducing latency, confirmation times, and operational overhead, we can make the process smoother and more efficient for everyone. This way, the system becomes faster and more reliable, helping you get things done with less hassle.

Together, we define what AI should accomplish in your organization

Identify initial focus areas, and outline steps for progress.

Engagement Model

Architecture Planning

Focus: Chain selection, messaging models, and validation

Result: Defined interoperability structure

Implementation

Focus: Smart contracts, relayers, and routing logic

Result: Functional cross-chain environment

Testing

Focus: Stress and failure path testing

Result: Confirmed stability in varied scenarios

Deployment

Focus: Network rollout and monitoring

Result: Stable cross-chain operation

Maintenance

Focus: Upgrades, tuning, and expansion

Result: Controlled and scalable interoperability

Related Solutions

RWA Tokenization & Digital Securities

Tokenization is used when a real asset needs to be represented and managed in digital form. This may include equity, debt instruments, property, commodities, or fund shares. The goal is clear ownership records, controlled access, and reliable transfer workflows. Expertise in RWA Tokenization & Digital Securities We work on systems where every ownership change must…

Are You Ready to Start? A Whole Team at Your Disposal

Reasons to choose FortySeven Software Professionals

Our development process is the natural evolution of a software process to support today’s changing business environment. We believe that every project should be dealt with a fresh approach. Our industry knowledge allows us to deliver solutions that solve business challenges in 40+ industries. Working closely with you, we define your needs and devise effective automation tool concepts, knowing how to implement these concepts and integrate them according to your specific needs.