There are many terms associated with the Venture Capital industry that might even not be known to other investors and entrepreneurs. FinTech is here for a long distance. Venture capital is a subset of private equity (PE). Who was the first person, raising a fund? Georges Doriot, professor of Harvard Business School generally is considered as the “Father of Venture Capital”.

He started the American Research and Development Corporation (ARDC) in 1946 and raised a $3.5 million fund to invest in companies that commercialized technologies developed during the Second World War. The story didn’t end with the raising of $3.5 million fund. After a while, his corporation, ARDC invested in a company that had ambitions to use x-ray technology for cancer treatment. The $200,000 that Doriot invested turned into $1.8 million when the company went public in 1955. According to historical facts, this was a great example of how Venture Capital works.

Nowadays, Venture Capital Firms became very popular, especially when we are talking about the startups and the new ideas of entrepreneurs. FortySeven Software Professionals knows what software solutions can help to become pioneers in the fintech industry. Here is a brief of how we helped Venture Capital Firm to invest in FinTech.

Our client is an established Venture Capital firm based in London with international branches in Beijing, Tel Aviv, Paris and Los Angeles, mainly investing in Financial Technology startups. The firm approached FortySeven Software Professionals to help them to expand the development team of one of the startups they invested in.

1. The objective was to enhance the software engineering and operation capabilities of the startup by adding specialist staff while keeping within a preset budget.

2. The client required us to provide a fully dedicated team of experts to take on certain development tasks and speed up development time in a cost efficient way, while having full control of the development process and IP ownership.

3. After assessing the structure of the startup’s development team, FortySeven incorporated a number of experts according to the requirements of the chief technology officer, executing tasks as instructed within time deadlines.

4. The development needs of the startup were achieved implementing Scrum, Agile development and Sprints that allowed for adaptation and flexibility throughout the process, based on Time & Materials.

The results at the end of the development period were completion of the software development plan within the deadline. Startup launched commercial version of the project within budget and had a successful round of investment after the development success.

During this case, FortySeven’ experts were responsible for: technical specifications development, software development and QA, information infrastructure development, UI/UX and design.

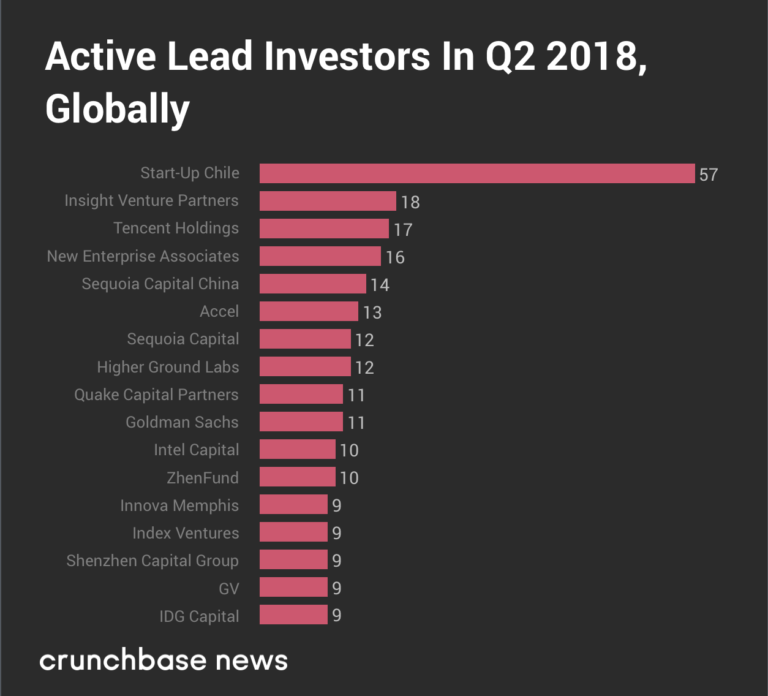

According to data from Crunchbase on investments made in Q2 2018, here are the 10 most active lead investors.

1. Start-Up Chile

3. Tencent Holdings

4. Tencent New Enterprise Associates

5. Sequoia Capital China

6. Accel

8. Higher Ground Labs

9. Quake Capital Partners

10. Goldman Sachs

Nowadays, new record amounts of investment are being made for startups and not only in FinTech industry. If you are an entrepreneur looking for active investors, first learn who your ideal investors are, and try to make a powerful pitch that will close your deal faster.